Starting your carpentry apprenticeship is an exciting time. You’re earning money, learning new skills, and maybe even eyeing that dream ute. But with a steady income comes the responsibility of managing it wisely.

Budgeting might not sound thrilling, but it’s the foundation for achieving your goals, whether that’s buying tools, saving for a holiday, or eventually starting your own business.

WHY BUDGETING MATTERS

As an apprentice, your income might be modest, but expenses can add up really quickly (tools, work gear, daily living costs, travel, taxes, rent, etc.). Without a proper budget, it is quite easy to lose track of your finances and find yourself short when it matters the most.

Budgeting can help you:

- Understand where your money is going

- Avoid preventable debt

- Prepare for future expenses

- Save for big-ticket items

BUILDING A BASIC BUDGET

Budgeting is more than just income and expenses. It’s about having a clear snapshot of your financial life. Here’s a practical way to build a more effective budget:

- Understand Your Actual Income: Know what you bring home after taxes and deductions. If your income fluctuates month to month because of overtime or inconsistent hours, be conservative with your estimation (base your estimation on your average or lowest earnings).

- Categorise Your Spending: Break down expenses into categories like housing, transport, work costs, personal spending, and savings. This helps identify areas where you might over or underspend.

- Understand All of Your Expenditures: Understand all of your outflows. While keeping track of expenses like rent, utilities, and insurance is easy, purchases such as daily coffee or takeaway meals can be more difficult.

- Differentiate Needs vs. Wants: Prioritise essential costs (rent, bills, transport) over discretionary spending (eating out, subscriptions). This makes it easier to adjust your habits and save more effectively.

- Build Up an Emergency Fund: Even small contributions accumulate over time, creating a safety net for unexpected costs, like tool replacements or vehicle repairs.

- Set Savings Goals: Clearly define short-term goals (buying tools) and long-term goals (holidays, starting a business, etc.). Allocate specific amounts from each pay towards these goals.

Regularly checking in on your budget (weekly or monthly) allows you to adjust as needed and ensures your money aligns with your priorities.

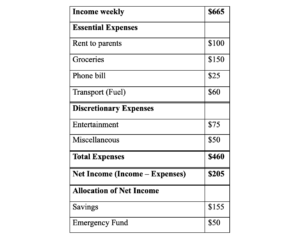

Here’s an example of a budget and savings breakdown to show how easy it can be for you to manage money and reach your financial goals.

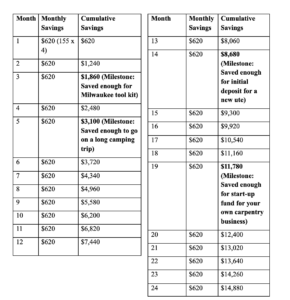

Savings Accumulation Over 2 Years

( With Milestones)

BUDGETING AND GOAL SETTING

Budgeting isn’t just about watching and understanding your spending. It is also about directing your funds toward what actually matters to you by creating a well-thought-out budget. Once you have clarity on your finances, setting specific and meaningful goals becomes easier, keeping you motivated and on track. Whether it’s steadily building your tool kit so you can confidently handle any job site, saving enough for a holiday, or even planning to start your own carpentry business down the track, clear goals keep you motivated.

FREE BUDGETING TOOLS TO GET YOU STARTED

There is no need to do all of your budgeting manually. Here are a couple of free, government-endorsed tools to assist you:

- ASIC’s MoneySmart Budget Planner: This webpage contains a useful budget planner tool, and an Excel version is also available. It is easy to download, save, and update your budget whenever necessary.

- ATO myDeductions App: This app lets you easily record and track your work-related expenses, receipts, and deductions in one place. It simplifies the process of keeping organised records for tax time.

STAY SMART, STAY AHEAD

Managing your money wisely early as an apprentice will set you up for success down the road. Budgeting isn’t complicated, but the benefits can be enormous. Budgeting helps you stay organised, hit your goals, and will reduce your stress about your finances. Taking control of your budget now means fewer worries later, so stay smart, stay ahead, and make your apprenticeship count.

2 Responses

Jiliwin11 is the main, nice payouts. Easy to use and the design is smooth, and no delays on the money. You gotta give it a look: jiliwin11

Spent some time on tara777com and it’s got a good vibe. I’m enjoying the site. See what you think: tara777com.